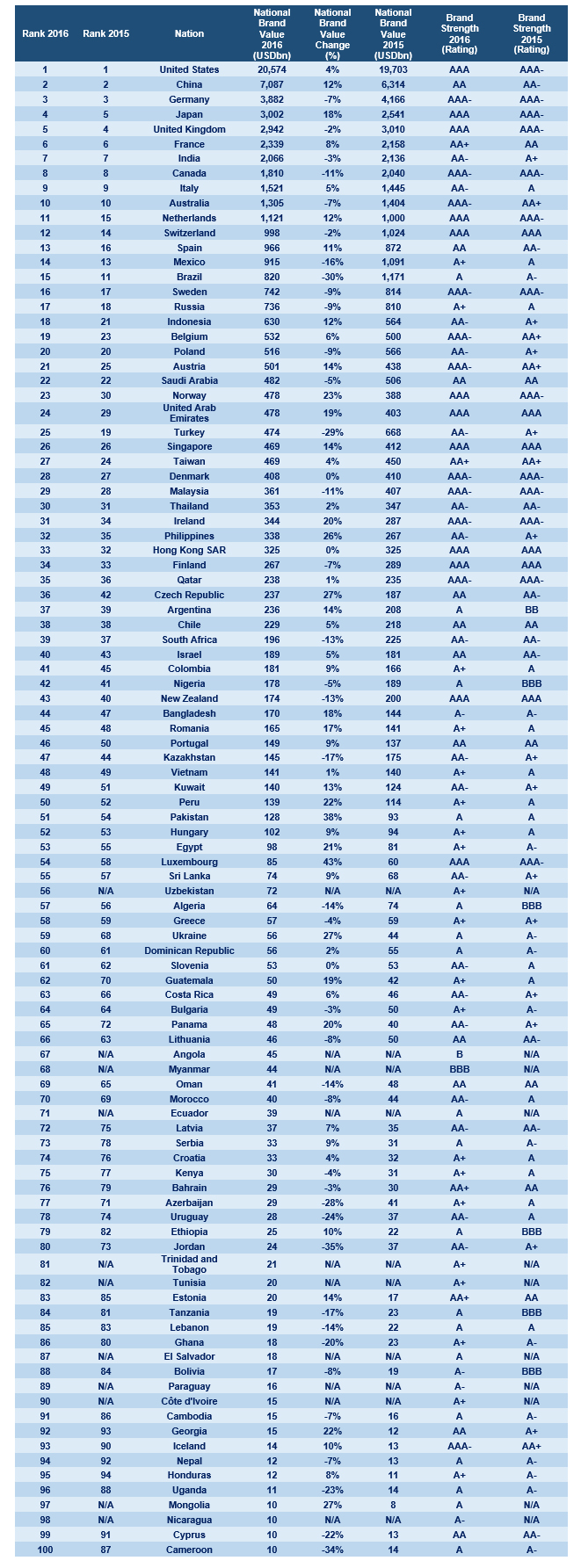

Nation Brand Values Revealed

- US, the most valuable nation brand, grows 4% despite fears of Trump presidency

- UK yet to feel the impact of EU referendum but confirmation of a ‘Hard Brexit’ could see value plunge in 2017

- Luxembourg is the fastest growing nation brand this year, up 43%

- Singapore remains the most powerful nation brand, when the impact of GDP is removed

- Pakistan and Ukraine grow strongly while Turkey, Brazil and Jordan fall

Every year, leading valuation and strategy consultancy, Brand Finance, puts thousands of the world’s top corporate brands to the test. However, in recognition of the growing influence of national image on the success of both companies and national economies, Brand Finance also evaluates the 100 most valuable nation brands, published in the Brand Finance Nation Brands report.

The United States continues its dominance of the Brand Finance Nation Brands table, adding US$871 billion following 4% growth. Even this modest increase may be under threat however. In just over two weeks, the US could be led by Donald Trump, whose xenophobic stance and protectionist rhetoric threatens to antagonise businesses, prospective foreign workers, students and governments.

Like the US, the UK has maintained a steady, if modest rate of growth despite Brexit and the depreciation of Sterling against the dollar over the past year. The lack of movement reflects the fact that Brexit’s consequences are as yet unclear. A great deal depends on the nature of the trade arrangement Theresa May is able to form with the EU. The short-term picture for manufacturing exporters is actually somewhat positive as a result of the devaluation of the pound and the continued ability to freely recruit EU workers. However a so called ‘hard-brexit’, leading to the implementation of barriers to capital, trade and migration could have severe consequences across the board for both the manufacturing and service industries. A deadline of March 2017 has been set for triggering Article 50 so next year’s Brand Finance Nation Brands results should start to provide a clearer picture of the impact of Brexit on brand Britain.

Luxembourg is this year’s fastest growing nation brand, having increased 43% to US$85 billion. The Grand Duchy is attempting to rapidly shed its reputation for financial secrecy and more particularly the taint of impropriety left by the LuxLeaks scandal of 2014. In its aftermath, Luxembourg initiated a concerted nation brand campaign to unify its messages and highlight the Grand Duchy’s Strengths. Reliability, Dynamism and Openness are highlighted as the country’s core strengths in a refreshingly low-key campaign that is distinguished by its focus on credible attributes rather than aspirations.

Pakistan is the second fastest riser, with a year on year increase of 41%. Pakistan is implementing a series of economic reforms backed by and necessary for a tranche of payments from the IMF. Lower oil prices also continue to work in the country’s favour, as does an improving security environment, despite the impression that recent escalating tensions in Kashmir might give. Pakistan must maintain the discipline it has shown in pursuing its reform program once the structure of IMF targets have been removed if it is to continue to grow nation brand value.

Ukraine’s economy remains finely balanced as its stand-off with Russia over the Donbas continues and despite the lack of international recognition, Crimea’s status as part of Russia appears to be confirmed. However having already suffered significant damage since the start of the war, the relative stability of this year sees brand value climbing upwards again. Brand strength metrics for security rose 18.2%, with a corresponding 11.4% rise in the quality of life score and a big improvement in the country’s ability to retain its most talented workers. Brand Value is up 39% making Ukraine the third fastest riser this year.

At the other end of the scale, Jordan is this year’s biggest faller as a result of continued conflict in neighbouring Syria. As the World Bank reports, the security situation is deteriorating, affecting tourism, construction and trade. Meanwhile unemployment is rising. With no prospect of the situation in Syria improving, a turnaround in Jordan is unlikely for now.

Turkey is another country that is suffering from the instability of its war torn neighbour. However, this year’s failed coup and in particular the government’s response have been more significant. There has been a furious backlash, which in the opinion of many international observers goes beyond a proportionate response. In addition to mass arrests of army offices, 2,700 judges and 40,000 teachers have been removed from their posts. Erdogan has also hinted at the reintroduction of the death penalty. Even before the coup Turkey’s president appeared to be steering the country away from the track it had been taking towards EU membership but the government’s response to the coup and its displeasure at the reactions of western governments have made this trajectory much more overt and concerted. In this context it will come as little surprise that Turkey’s nation brand value has fallen more rapidly than that of almost any country this year. It is down to US$474 billion, a 29% drop.

Brazil has dropped even further than Turkey however. The Olympic Games did deliver a boost to tourism – Brazil’s brand strength score for tourism rose 12% on 2016. However the ailing economy, declining value of the Real and the Petrobras corruption scandal eclipse this, driving Brazil’s nation brand value down 30%. Perceptions of corruption are up 0.5%, the IMF predicts a further 8% decline in GDF before the end of 2017 while the country’s discount rate has risen from 9.9% to 17.8% reflecting the pessimistic economic outlook and suggesting further falls to come.

Singapore last year claimed the title of World’s strongest Nation Brand and has held off close challenges from Hong Kong and Switzerland to do the same again this year. Nation Brand value is reliant upon GDP, (i.e. the revenues associated with the brand). Singapore’s small size means it will never be able to challenge for the top spot in brand value terms, because its brand simply cannot be applied extensively enough to generate the same economic uplift as ‘brand USA’ for example. However it terms of its underlying nation brand strength, Singapore comes out on top.

The 100 Most Valuable Nation Brands (USDbn)

| Rank 2016 | Rank 2015 | Nation | National Brand Value 2016 (USDbn) |

National Brand Value Change (%) |

National Brand Value 2015 (USDbn) |

Brand Strength 2016 (Rating) |

Brand Strength 2015 (Rating) |

| 1 | 1 | United States | 20,574 | 4% | 19,703 | AAA | AAA- |

| 2 | 2 | China | 7,087 | 12% | 6,314 | AA | AA- |

| 3 | 3 | Germany | 3,882 | -7% | 4,166 | AAA- | AAA- |

| 4 | 5 | Japan | 3,002 | 18% | 2,541 | AAA | AAA- |

| 5 | 4 | United Kingdom | 2,942 | -2% | 3,010 | AAA | AAA- |

| 6 | 6 | France | 2,339 | 8% | 2,158 | AA+ | AA |

| 7 | 7 | India | 2,066 | -3% | 2,136 | AA- | A+ |

| 8 | 8 | Canada | 1,810 | -11% | 2,040 | AAA- | AAA- |

| 9 | 9 | Italy | 1,521 | 5% | 1,445 | AA- | A |

| 10 | 10 | Australia | 1,305 | -7% | 1,404 | AAA- | AA+ |

| 11 | 15 | Netherlands | 1,121 | 12% | 1,000 | AAA | AAA- |

| 12 | 14 | Switzerland | 998 | -2% | 1,024 | AAA | AAA |

| 13 | 16 | Spain | 966 | 11% | 872 | AA | AA- |

| 14 | 13 | Mexico | 915 | -16% | 1,091 | A+ | A |

| 15 | 11 | Brazil | 820 | -30% | 1,171 | A | A- |

| 16 | 17 | Sweden | 742 | -9% | 814 | AAA- | AAA- |

| 17 | 18 | Russia | 736 | -9% | 810 | A+ | A |

| 18 | 21 | Indonesia | 630 | 12% | 564 | AA- | A+ |

| 19 | 23 | Belgium | 532 | 6% | 500 | AAA- | AA+ |

| 20 | 20 | Poland | 516 | -9% | 566 | AA- | A+ |

| 21 | 25 | Austria | 501 | 14% | 438 | AAA- | AA+ |

| 22 | 22 | Saudi Arabia | 482 | -5% | 506 | AA | AA |

| 23 | 30 | Norway | 478 | 23% | 388 | AAA | AAA- |

| 24 | 29 | United Arab Emirates | 478 | 19% | 403 | AAA | AAA |

| 25 | 19 | Turkey | 474 | -29% | 668 | AA- | A+ |

| 26 | 26 | Singapore | 469 | 14% | 412 | AAA | AAA |

| 27 | 24 | Taiwan | 469 | 4% | 450 | AA+ | AA+ |

| 28 | 27 | Denmark | 408 | 0% | 410 | AAA- | AAA- |

| 29 | 28 | Malaysia | 361 | -11% | 407 | AAA- | AAA- |

| 30 | 31 | Thailand | 353 | 2% | 347 | AA- | AA- |

| 31 | 34 | Ireland | 344 | 20% | 287 | AAA- | AAA- |

| 32 | 35 | Philippines | 338 | 26% | 267 | AA- | A+ |

| 33 | 32 | Hong Kong SAR | 325 | 0% | 325 | AAA | AAA |

| 34 | 33 | Finland | 267 | -7% | 289 | AAA | AAA |

| 35 | 36 | Qatar | 238 | 1% | 235 | AAA- | AAA- |

| 36 | 42 | Czech Republic | 237 | 27% | 187 | AA | AA- |

| 37 | 39 | Argentina | 236 | 14% | 208 | A | BB |

| 38 | 38 | Chile | 229 | 5% | 218 | AA | AA |

| 39 | 37 | South Africa | 196 | -13% | 225 | AA- | AA- |

| 40 | 43 | Israel | 189 | 5% | 181 | AA | AA- |

| 41 | 45 | Colombia | 181 | 9% | 166 | A+ | A |

| 42 | 41 | Nigeria | 178 | -5% | 189 | A | BBB |

| 43 | 40 | New Zealand | 174 | -13% | 200 | AAA | AAA |

| 44 | 47 | Bangladesh | 170 | 18% | 144 | A- | A- |

| 45 | 48 | Romania | 165 | 17% | 141 | A+ | A |

| 46 | 50 | Portugal | 149 | 9% | 137 | AA | AA |

| 47 | 44 | Kazakhstan | 145 | -17% | 175 | AA- | A+ |

| 48 | 49 | Vietnam | 141 | 1% | 140 | A+ | A |

| 49 | 51 | Kuwait | 140 | 13% | 124 | AA- | A+ |

| 50 | 52 | Peru | 139 | 22% | 114 | A+ | A |

| 51 | 54 | Pakistan | 128 | 38% | 93 | A | A |

| 52 | 53 | Hungary | 102 | 9% | 94 | A+ | A |

| 53 | 55 | Egypt | 98 | 21% | 81 | A+ | A- |

| 54 | 58 | Luxembourg | 85 | 43% | 60 | AAA | AAA- |

| 55 | 57 | Sri Lanka | 74 | 9% | 68 | AA- | A+ |

| 56 | N/A | Uzbekistan | 72 | N/A | N/A | A+ | N/A |

| 57 | 56 | Algeria | 64 | -14% | 74 | A | BBB |

| 58 | 59 | Greece | 57 | -4% | 59 | A+ | A+ |

| 59 | 68 | Ukraine | 56 | 27% | 44 | A | A- |

| 60 | 61 | Dominican Republic | 56 | 2% | 55 | A | A- |

| 61 | 62 | Slovenia | 53 | 0% | 53 | AA- | A |

| 62 | 70 | Guatemala | 50 | 19% | 42 | A+ | A |

| 63 | 66 | Costa Rica | 49 | 6% | 46 | AA- | A+ |

| 64 | 64 | Bulgaria | 49 | -3% | 50 | A+ | A- |

| 65 | 72 | Panama | 48 | 20% | 40 | AA- | A+ |

| 66 | 63 | Lithuania | 46 | -8% | 50 | AA | AA- |

| 67 | N/A | Angola | 45 | N/A | N/A | B | N/A |

| 68 | N/A | Myanmar | 44 | N/A | N/A | BBB | N/A |

| 69 | 65 | Oman | 41 | -14% | 48 | AA | AA |

| 70 | 69 | Morocco | 40 | -8% | 44 | AA- | A |

| 71 | N/A | Ecuador | 39 | N/A | N/A | A | N/A |

| 72 | 75 | Latvia | 37 | 7% | 35 | AA- | AA- |

| 73 | 78 | Serbia | 33 | 9% | 31 | A | A- |

| 74 | 76 | Croatia | 33 | 4% | 32 | A+ | A |

| 75 | 77 | Kenya | 30 | -4% | 31 | A+ | A |

| 76 | 79 | Bahrain | 29 | -3% | 30 | AA+ | AA |

| 77 | 71 | Azerbaijan | 29 | -28% | 41 | A+ | A |

| 78 | 74 | Uruguay | 28 | -24% | 37 | AA- | A |

| 79 | 82 | Ethiopia | 25 | 10% | 22 | A | BBB |

| 80 | 73 | Jordan | 24 | -35% | 37 | AA- | A+ |

| 81 | N/A | Trinidad and Tobago | 21 | N/A | N/A | A+ | N/A |

| 82 | N/A | Tunisia | 20 | N/A | N/A | A+ | N/A |

| 83 | 85 | Estonia | 20 | 14% | 17 | AA+ | AA |

| 84 | 81 | Tanzania | 19 | -17% | 23 | A | BBB |

| 85 | 83 | Lebanon | 19 | -14% | 22 | A | A |

| 86 | 80 | Ghana | 18 | -20% | 23 | A+ | A- |

| 87 | N/A | El Salvador | 18 | N/A | N/A | A | N/A |

| 88 | 84 | Bolivia | 17 | -8% | 19 | A- | BBB |

| 89 | N/A | Paraguay | 16 | N/A | N/A | A- | N/A |

| 90 | N/A | Côte d’Ivoire | 15 | N/A | N/A | A+ | N/A |

| 91 | 86 | Cambodia | 15 | -7% | 16 | A | A- |

| 92 | 93 | Georgia | 15 | 22% | 12 | AA | A+ |

| 93 | 90 | Iceland | 14 | 10% | 13 | AAA- | AA+ |

| 94 | 92 | Nepal | 12 | -7% | 13 | A | A- |

| 95 | 94 | Honduras | 12 | 8% | 11 | A+ | A- |

| 96 | 88 | Uganda | 11 | -23% | 14 | A | A- |

| 97 | N/A | Mongolia | 10 | 27% | 8 | A | N/A |

| 98 | N/A | Nicaragua | 10 | N/A | N/A | A- | N/A |

| 99 | 91 | Cyprus | 10 | -22% | 13 | AA | AA- |

| 100 | 87 | Cameroon | 10 | -34% | 14 | A | A- |

To share this table , use the image below: